In a fast-moving digital assets landscape, the Hedera price and its native token, HBAR, stand apart thanks to both robust technology and a rapidly growing ecosystem. Unlike traditional blockchains that rely on proof-of-work or proof-of-stake, Hedera Hashgraph utilizes a unique consensus mechanism known as hashgraph—offering high throughput, predictable fees, and remarkable energy efficiency. This distinctive foundation has positioned Hedera as a credible alternative for enterprises and emerging decentralized applications, fueling both developer adoption and market speculation.

As institutional interest in distributed ledger technology grows, monitoring HBAR’s live price, historical chart patterns, and market trends has become crucial for investors, developers, and blockchain enthusiasts seeking insight and opportunity in the evolving Web3 economy.

The Current State of HBAR: Live Price and Key Metrics

Real-Time Pricing and Volume Analysis

HBAR is traded on major exchanges and is tracked by leading price aggregation platforms. The live price of HBAR fluctuates based on global market sentiment, liquidity, and volume. Over recent months, HBAR’s price has reflected broader crypto market volatility—experiencing sharp rallies during industry-wide uptrends and retracements amid macroeconomic uncertainty.

Key metrics driving HBAR’s value include:

- Market Capitalization: HBAR regularly ranks among the top 50 cryptocurrencies by market cap, signaling strong network fundamentals and deep liquidity.

- 24h Trading Volume: The token enjoys significant daily trading volume, which underpins tight bid–ask spreads and supports short-term trading strategies.

- Circulating vs. Total Supply: Hedera’s tokenomics balances circulating supply with strategic network growth, influencing price dynamics and long-term valuation.

Youthful blockchains often see outsized price swings, but Hedera has begun to establish more predictable trading behavior as institutional partnerships and integrations increase.

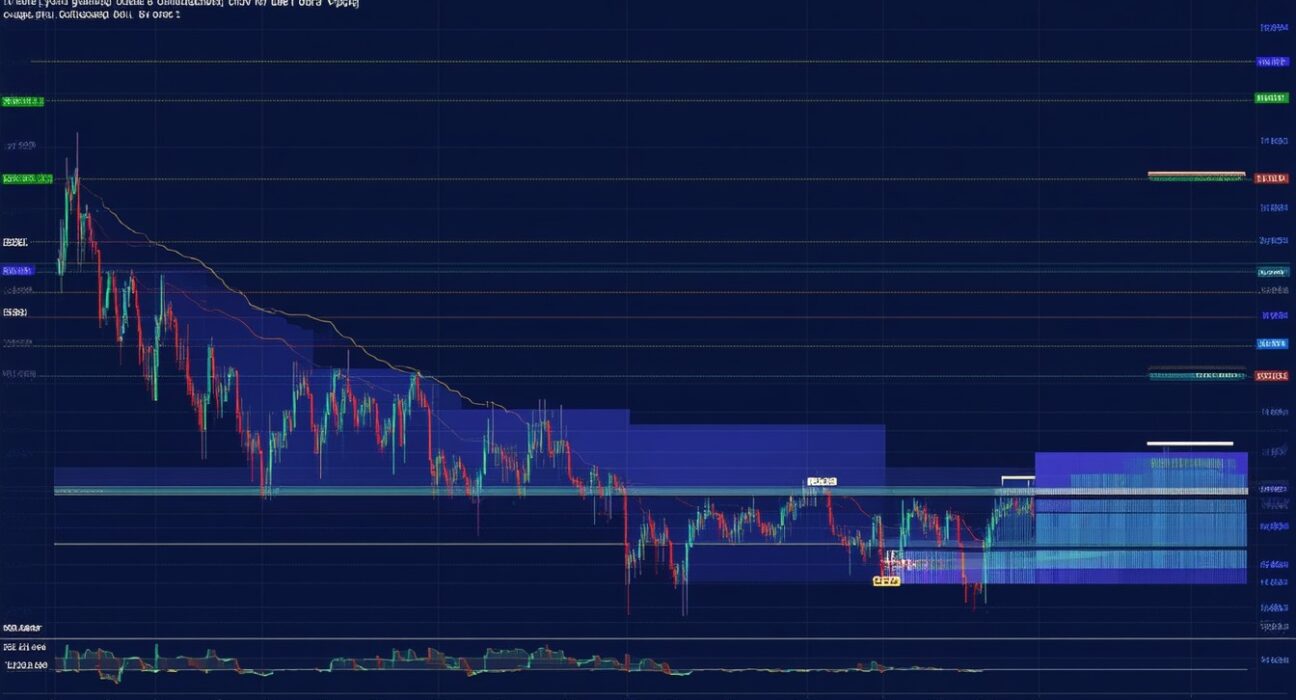

Hedera Price Chart Patterns

In examining HBAR’s price chart, several themes have emerged:

– Resistance and Support Zones: Certain price levels become psychological benchmarks for traders, often based on historical highs or important news events.

– Trend Patterns: HBAR’s price has at times experienced both rapid breakouts and periods of consolidation, reflecting shifting investor sentiment.

– Correlation with Industry Events: Price action often intensifies around major network updates, regulatory developments, or high-profile partnerships.

Recent upward momentum in early 2024 has been attributed to new enterprise partnerships and tangible network usage.

Technical Analysis: HBAR’s Recent Price Movements

Price Drivers and Market Sentiment

Analyzing the HBAR chart reveals insightful technical indicators. Relative strength index (RSI), moving averages, and Fibonacci retracement levels are among common tools used by traders.

- RSI Overbought/Oversold Levels: During periods when HBAR’s RSI moves above 70 or below 30, sharp short-term reversals may occur.

- 50-day/200-day Moving Averages: Crossovers often signal momentum shifts, attracting both institutional and retail attention.

- Volume Surges: Spikes in trading volume frequently coincide with breakout or breakdown events.

“The recent surge in HBAR’s trading activity mirrors growing confidence in Hedera’s enterprise use cases, particularly as more Fortune 500 companies integrate distributed ledger solutions.”

— Blockchain Industry Analyst, CryptoCompare

Notable Trends and Price Events

HBAR’s value tends to respond acutely to:

– Partnership Announcements: Collaborations with technology leaders often produce immediate upward price momentum.

– Ecosystem Updates: Upgrades to the Hedera network or new application launches can trigger speculative rallies.

– Macro Market Swings: Like most cryptocurrencies, HBAR’s trendlines often correlate with general Bitcoin and Ethereum price action, but recent divergence indicates maturing investor profiles.

Fundamentals: What Sets Hedera (HBAR) Apart?

Technology: Hashgraph Consensus Explained

Unlike conventional blockchain models, Hedera’s hashgraph algorithm enables asynchronous Byzantine Fault Tolerance (aBFT), granting exceptionally high transaction speeds and security.

Notable technical advantages include:

– High Throughput: Thousands of transactions per second, surpassing typical blockchain alternatives.

– Fixed Low Fees: Transaction costs remain tiny and predictable, regardless of network congestion.

– Sustainability: Minimal energy consumption has made HBAR particularly appealing in sustainability-conscious enterprise environments.

This technical prowess has contributed to increasing network adoption in enterprise and DeFi sectors alike.

Governance and Ecosystem Growth

Hedera’s governance is overseen by a global council of blue-chip enterprises, including titans such as Google, IBM, and Boeing. This diverse governing strategy helps ensure network resilience, legal compliance, and pragmatic decision-making.

The broader ecosystem has seen:

- Enterprise Integrations: Companies exploring supply chain, identity, and payments solutions built on Hedera.

- Decentralized Applications (dApps): Growth in DEXs, NFT platforms, and gaming projects leveraging Hedera’s unique capabilities.

- Developer Activity: Semester-over-semester increases in smart contract deployments and mainnet transactions.

These fundamental drivers underpin long-term confidence in the Hedera price, beyond short-term market speculation.

Real-World Use Cases and Strategic Partnerships

Hedera’s market reputation is anchored by substantive, real-world deployments rather than mere hype. Sectors such as supply chain, healthcare, and digital identity have begun to recognize the platform’s efficiency and security.

Major Partnerships and Their Impact

Recent partnerships exemplify strategic momentum:

– Avery Dennison: Leveraging Hedera for supply chain transparency solutions.

– ServiceNow: Exploring enterprise workflow innovations using Hedera’s public network.

– Shinhan Bank: Collaborated on stablecoin and cross-border remittance proof-of-concepts on Hedera’s platform.

Each high-profile integration in turn creates price tailwinds by increasing token utility and mainstream visibility.

Market Risks and Forward Perspectives

No digital asset is without risk. HBAR’s price is influenced by both opportunity and uncertainty.

Volatility and Competition

- Market Volatility: Crypto assets, HBAR included, are notoriously prone to sharp price fluctuations influenced by global liquidity cycles and regulatory news.

- Competitive Landscape: Newer Layer 1 networks and evolving Layer 2 solutions compete fiercely for adoption, which may pressure future price growth.

Outlook and Strategic Considerations

Despite these risks, Hedera’s combination of enterprise backing, technological differentiation, and real-world use cases places it in a unique category. Continued network adoption and responsible ecosystem development remain central to HBAR’s long-term price prospects.

Conclusion: Key Takeaways for Investors and Observers

Hedera’s distinct technology, strong enterprise governance, and growing adoption underscore its rising prominence in the digital asset arena. While HBAR’s price will likely remain volatile in the near term, ongoing enterprise partnerships, robust sustainability credentials, and forward-looking technical improvements give the project lasting potential. Sound portfolio strategy recognizes both the risks and the outsized opportunities that a rapidly maturing network like Hedera presents.

FAQs

What factors most influence Hedera’s (HBAR) price movements?

Major price drivers include enterprise adoption, technical upgrades, strategic partnerships, and overall sentiment in the broader crypto market.

How can I track the live price of HBAR?

The live price of HBAR is available on most major cryptocurrency exchanges and price aggregators, usually updating in real-time with market fluctuations.

What makes Hedera’s technology unique compared to other blockchains?

Hedera uses a hashgraph consensus algorithm, enabling higher throughput, predictable low transaction fees, and enhanced energy efficiency compared to traditional blockchain technology.

Is HBAR considered a secure long-term investment?

While Hedera boasts strong fundamentals and reputable governance, cryptocurrency investments remain risky due to volatility and market uncertainty; professional consultation and due diligence are suggested.

Which enterprises are actively involved in Hedera’s governance?

A diverse global council oversees Hedera, including companies like Google, IBM, Tata Communications, and Boeing, each playing a role in network decision-making.

What are the main use cases for HBAR?

HBAR powers transaction fees, staking, and smart contracts; it is used in real-world solutions for supply chain management, payments, digital identity, and next-generation decentralized applications.