As the momentum behind blockchain innovation accelerates, SEI crypto has carved out a distinct presence in the expanding world of digital assets. Built to address inefficiencies plaguing decentralized exchanges, SEI’s modular, high-throughput blockchain has rapidly attracted not only crypto traders but also developers eager to build the next generation of DeFi (Decentralized Finance) applications. Against a backdrop of volatile markets and ever-shifting regulatory landscapes, SEI stands as both a technical achievement and a telling barometer of crypto’s evolution.

What Is SEI Crypto? Platform Fundamentals and Market Context

SEI crypto is the native token of the Sei Network—a Layer 1 blockchain leveraging the Cosmos SDK. SEI is engineered first and foremost for trading applications, offering ultra-fast transaction speeds and high throughput to support liquid, scalable decentralized marketplaces.

The broader blockchain sector has seen a surge in Layer 1 innovation, with many platforms honing in on unique network architectures or use cases. SEI distinguishes itself through its focus on optimizing order book-based DEX (Decentralized Exchange) infrastructure, striving for sub-second finality to give both traders and builders a competitive edge.

Key Features of SEI

- Optimized for Speed: SEI claims block times as low as 500 milliseconds, markedly faster than many legacy chains.

- Parallel Processing: Leveraging parallelization, SEI dramatically increases transaction throughput.

- Native Order-Matching: It offers built-in order-matching engines, removing latency typical in smart contract-based DEXs.

- Composability: As part of the Inter-Blockchain Communication (IBC) protocol within the Cosmos ecosystem, SEI can interoperate seamlessly with other blockchains.

These features have drawn the attention of both major liquidity providers and emerging DeFi projects seeking reliable, low-cost settlement solutions.

SEI Crypto Price: Recent Performance and Volatility Drivers

SEI’s price has seen notable swings since its listing on major exchanges. Like other Layer 1 tokens, its value is shaped by a web of factors:

- Network Growth: Sustained user adoption and developer activity can lift confidence, boosting SEI’s market cap.

- Macro Trends: Broader crypto market cycles—impacted by regulatory events, Bitcoin halving, or global economic news—also influence SEI’s pricing.

- Tokenomics and Utility: With a finite supply and staking incentives, SEI’s supply dynamics impact long-term sentiment.

Unlike meme coins or speculative tokens, SEI’s narrative centers largely on real-world utility and developer traction. This can sometimes dampen short-term hype, but many observers view this as a signal of resilience.

“Tokens that underpin tangible network activity, like SEI, tend to see steadier adoption even in turbulent cycles. Utility must ultimately drive legacy,” observes blockchain analyst Hayley Tran.

Market Comparisons

When analyzed alongside other modular Layer 1 tokens—such as Solana (SOL) or Avalanche (AVAX)—SEI’s price action reflects both the exuberance and caution characteristic of early-stage ecosystems. While SEI achieved rapid exchange listings and notable initial volumes, its price has at times exhibited double-digit daily percentage moves, symptomatic of both emerging ecosystem risk and upside speculation.

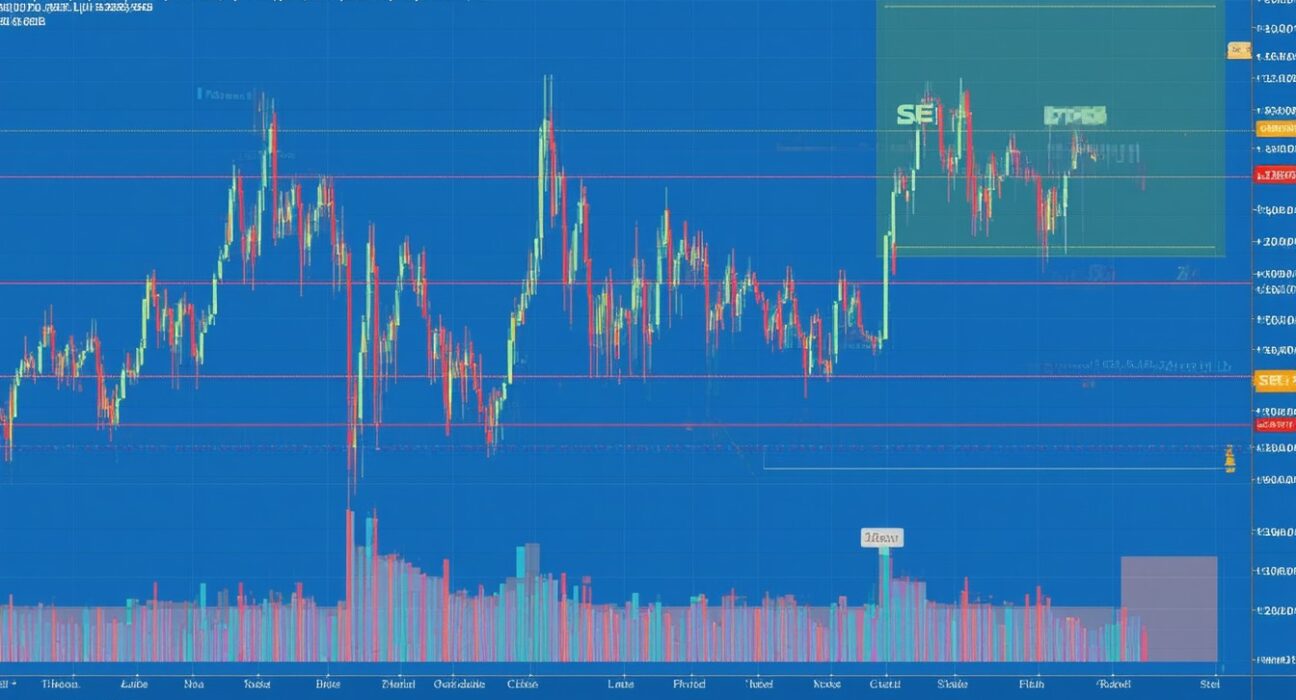

Technical Analysis: SEI Crypto Chart Patterns and Trends

Recent chart analysis reveals classic cryptocurrency dynamics playing out in the SEI market:

Support and Resistance

- Initial Support: After major exchange listings, SEI established an early support zone, with buyers stepping in on retracements below initial highs.

- Resistance Levels: Profit-taking at key psychological levels (such as $0.10, $0.15, etc.) has created resistance bands.

Trading Volumes and Liquidity

DEFI-based pairs and centralized exchanges alike have contributed to volatility. Order book depth—a critical health metric for any trading-focused chain—has generally kept pace with demand, though periods of thin liquidity have exaggerated short-term moves.

Moving Averages and Momentum

Short-term moving averages (e.g., 20- and 50-period) have often tracked price closely, with bullish crossovers coinciding with periods of ecosystem announcements or product launches.

Chart Analysis in Practice

For example, during a recent ecosystem grant program announcement, SEI’s price surged on increased social volume and on-chain activity—a pattern familiar across crypto, where developer progress and news cycles often precede technical breakout patterns.

SEI Crypto News: Key Developments and Their Impact

Beyond the numbers, newsworthy events often shape sentiment more than technicals alone.

Recent Ecosystem Catalysts

- DeFi Integrations: Several new protocols have adopted SEI for lower fees and faster execution, broadening the utility case.

- Partnerships: Collaborations with key CosmWasm projects have highlighted SEI’s focus on interoperability.

- Upgrades and Governance: Network upgrades, community votes, or proposed enhancements frequently precede price moves, echoing a pattern seen across major blockchains.

“Developers and traders both look for credible, incremental progress in project roadmaps. Sudden spikes or dips often map to tangible shipping of products, not just promises,” notes DeFi strategist Mikael D.

Regulatory Noise and Strategic Positioning

Amidst growing regulatory scrutiny of crypto platforms worldwide, SEI’s alignment with the Cosmos SDK—known for its modularity and customizability—has enabled adaptive compliance strategies. While direct regulation of Layer 1 blockchains remains murky, SEI’s open development process and cross-chain ethos have been praised for fostering transparency and flexibility.

SEI Token Utility: Beyond Price Speculation

Whereas many tokens rely solely on market speculation, SEI offers direct utility within the Sei Network.

Roles for SEI Token Holders

- Transaction Fees: Used as gas for all network transactions.

- Staking and Security: Users can stake SEI to secure the chain, earning protocol rewards in the process.

- Governance: Holders participate in on-chain governance, voting on network upgrades or ecosystem funding.

This multi-faceted utility model is designed to support long-term network health and give token holders tangible stakes in protocol evolution.

Risks and Considerations in SEI Crypto

No discussion of SEI, or any emerging crypto, is complete without acknowledging clear risks:

- Ecosystem Maturity: As a relatively young chain, application diversity and liquidity can lag behind more established platforms.

- Regulatory Uncertainty: As with all crypto assets, future regulatory developments could dramatically affect project adoption.

- Competition: The modular Layer 1 sector is rapidly evolving, with new entrants and technological breakthroughs a constant threat.

Balancing these risks against SEI’s strong technical platform and network effects is critical for interested investors or developers.

Conclusion: SEI Crypto’s Position and Outlook

SEI has quickly established itself as a notable player in the modular Layer 1 race, emphasizing both high-performance trading infrastructure and a robust utility-driven tokenomics model. While volatile price movements persist, SEI’s focus on composability, developer traction, and real-world integration signals long-term utility beyond simple speculation.

Those monitoring the sector should watch for ongoing ecosystem development, regulatory clarity, and the impact of cross-chain partnerships—all factors likely to influence SEI’s trajectory as both a token and a protocol.

FAQs

What is SEI crypto used for?

SEI is the native token for the Sei Network and is used to pay transaction fees, participate in network governance, and secure the blockchain through staking.

How fast is the Sei Network compared to other blockchains?

Sei Network is designed for sub-second block finality, making it significantly faster than many traditional blockchains like Ethereum or Bitcoin, especially when processing trading transactions.

Where can I buy SEI tokens?

SEI tokens are available on leading cryptocurrency exchanges, including both centralized and decentralized platforms supported within the Cosmos ecosystem.

What makes SEI crypto different from other Layer 1s?

SEI focuses on high-throughput trading, native order-matching, and deep composability as part of the Cosmos ecosystem, whereas other Layer 1s may prioritize broader general-purpose programmability.

Is SEI crypto a good investment?

As with any emerging crypto, investing in SEI involves both opportunity and risk. Many observers believe its technical foundation and growing ecosystem make it promising, but market volatility remains a factor.

Can SEI work with other blockchains?

Yes, SEI leverages the Inter-Blockchain Communication (IBC) protocol, allowing it to interoperate and exchange value with other IBC-compatible chains in the Cosmos network.