Shiba Inu (SHIB), once launched as a meme-inspired digital token, has transformed into a prominent feature in the cryptocurrency market. As investors and observers track the SHIB price in real time, its role has evolved from a speculative asset to a project with a developing ecosystem, community initiatives, and growing utility cases. Amidst market volatility, understanding SHIB’s price dynamics requires context, analysis of trends, and awareness of what drives this token’s valuation.

The Evolving Context of Shiba Inu Coin

SHIB’s meteoric rise began in early 2021, bolstered by social media buzz and a wave of interest in so-called meme coins—digital assets rooted in online culture rather than traditional project fundamentals. Despite its lighthearted origins, SHIB quickly garnered listings on leading exchanges, unlocking substantial liquidity and broad exposure. The surge in retail participation and the allure of overnight gains contributed to its erratic, yet notable, price activity.

Today, SHIB sits comfortably within the top ranks by market capitalization among cryptocurrencies. Its journey, however, reflects broader trends in the industry—fast-changing narratives, the influence of internet communities, and the growing appetite for experimentation among digital asset holders.

SHIB Price Live: Tracking Value and Volatility

Live SHIB price tracking has become essential for traders and investors seeking to capitalize on rapid market movements. Real-time price charts aggregate data from major exchanges, providing users with up-to-the-minute valuation, 24-hour high/lows, and trading volumes. Because SHIB operates on the Ethereum blockchain as an ERC-20 token, its price is affected not only by overall crypto market sentiment, but also by technical factors such as gas fees and network demand.

Major Exchanges and Key Liquidity Pools

The price of SHIB is most heavily influenced by activity on high-volume platforms such as Binance, Coinbase, and decentralized exchanges like Uniswap. Liquidity pools on these exchanges help ensure minimal slippage for significant trades, but also may contribute to abrupt swings during periods of increased demand or large sell-offs.

Notable Price Movements and Historical Trends

Over the last two years, SHIB has witnessed dramatic highs and lows. For example, in October 2021, a meteoric price surge captured global headlines, driven by a convergence of social media hype, listings on tier-one exchanges, and a wave of retail investment. Since then, periodic price corrections have mirrored shifts in general crypto market cycles.

“The SHIB price, like many altcoins, is a reflection of broader crypto sentiment—but it also benefits from unique, community-driven catalysts and emerging use cases,” notes digital asset strategist Rebecca M. Horton.

Market Analysis: What Influences SHIB Price?

Multiple factors contribute to the volatility and direction of the SHIB price. Unlike traditional financial assets, cryptocurrencies remain deeply influenced by sentiment, social channels, and speculative narratives.

Community Engagement and Social Media Buzz

Few coins can match SHIB’s social media presence. Dedicated online forums, frequent trending hashtags, and influential figures spur periodic spikes in attention and, by extension, market activity. The role of the so-called “SHIBArmy”—a passionate group of supporters—cannot be overstated in driving engagement, raising awareness, and mobilizing coordinated campaigns such as token burns and exchange petitions.

Ecosystem Growth and Technical Developments

Beyond the meme, Shiba Inu’s developers have undertaken several initiatives to bolster the token’s legitimacy and long-term prospects:

- ShibaSwap: A decentralized exchange platform enabling staking and liquidity provision.

- Shibarium: A much-anticipated layer-2 blockchain intended to reduce transaction costs and drive broader utility.

- NFT Projects: Expanding into digital collectibles, which attract a new segment of users.

Successful delivery of these technical milestones, or even clear communication about their progress, often correlates with upward price momentum.

Broader Crypto Market Movements

Mainstream risk appetite, Bitcoin’s performance, and global regulatory shifts are all factors that can buoy—or weigh down—the SHIB price. When Bitcoin rallies, SHIB and other altcoins often see sympathetic upward price movement. In times of uncertainty or negative regulatory headlines, SHIB tends to track downward along with the broader market.

SHIB Price Technical Analysis: Key Levels and Sentiment

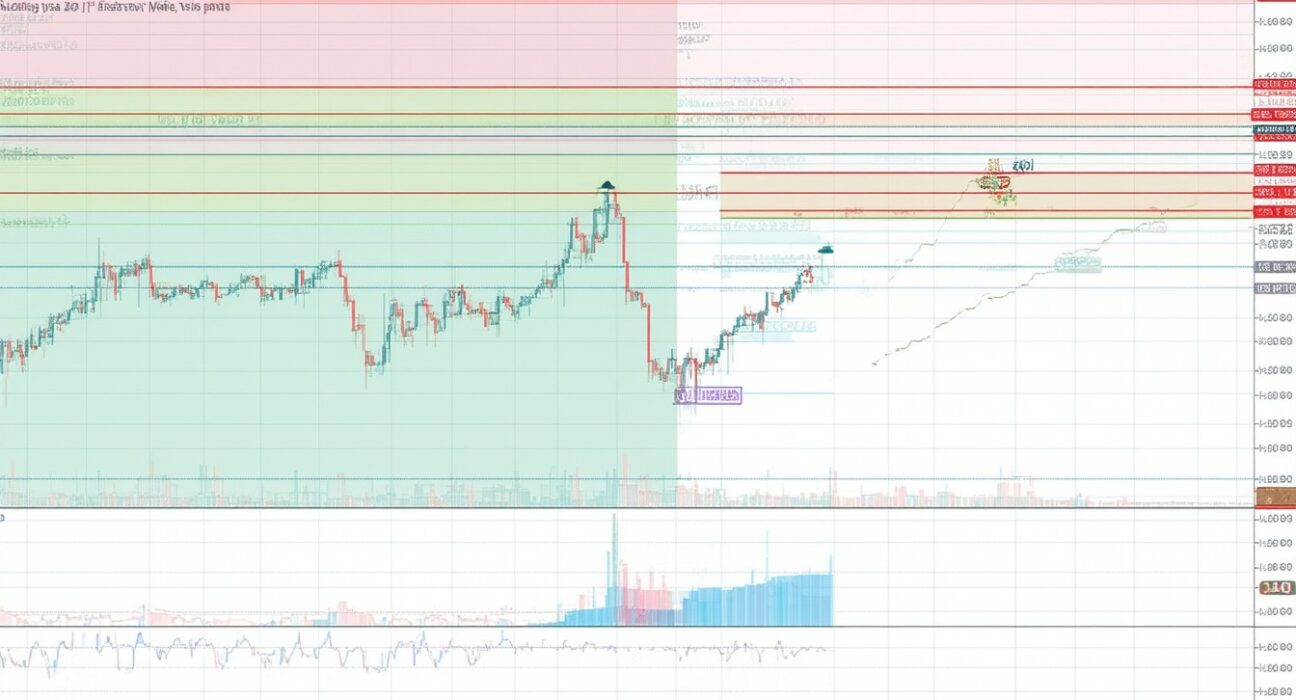

Technical analysts regularly assess SHIB price charts to identify potential entry and exit points. Several methods are commonly applied:

Chart Patterns and Support/Resistance Zones

SHIB’s price often follows classic chart patterns—such as cup-and-handle formations, flag patterns, and triangles—that traders monitor for breakout and breakdown scenarios. Key support levels, established during previous consolidations, can provide temporary “floors,” while resistance levels tend to act as obstacles during bull runs.

Volume Analysis and Order Book Dynamics

Changes in trading volumes signal shifts in momentum. For example, a spike in volume on a rally may confirm bullish sentiment, while declining volume alongside rising prices can indicate weakening interest and a higher risk of reversal.

Sentiment Indicators

Market sentiment data—such as funding rates, social media analytics, and derivatives market activity—can offer insight into whether buyers or sellers are dominating the market. Extreme bullish sentiment sometimes serves as a cautionary signal, suggesting an overheated market.

Future Outlook: Risks and Strategic Considerations

Looking ahead, SHIB’s price trajectory will likely hinge on both internal developments and external market factors. The team’s ability to deliver on ecosystem promises—like the rollout of Shibarium—will influence long-term value. At the same time, macroeconomic conditions and digital asset regulation remain potent wild cards.

Key Risks to Watch

- Speculative Sentiment: A significant portion of SHIB holdings sit with retail investors prone to rapid sentiment shifts.

- Regulatory Headwinds: Any tightening of rules around meme coins or broader crypto exchanges could curtail liquidity.

- Execution Risk: Failure to deliver on ecosystem initiatives may erode confidence and suppress price appreciation.

Opportunities Ahead

If the ecosystem matures as planned, and crypto markets turn risk-on, SHIB could further its transformation into a utility token rather than a speculative meme asset. Institutional recognition, continued burns reducing supply, and expanding use cases (such as payments or gaming) represent meaningful, if uncertain, catalysts.

Conclusion

Shiba Inu’s price story has been among crypto’s most captivating narratives, shaped by internet culture, speculative fervor, and serious attempts to build real-world utility. While its path remains volatile and unpredictable, SHIB demonstrates how meme coins have evolved to stay relevant in a rapidly shifting market. For market observers and investors, ongoing analysis—blending technical factors with ecosystem progress—will remain essential for understanding SHIB’s changing role and value in the digital asset economy.

FAQs

What determines the live price of SHIB?

The live price of SHIB is set by real-time supply and demand on cryptocurrency exchanges, which are influenced by market sentiment, trading volume, and broader trends in the crypto sector.

How can I track SHIB’s price changes accurately?

Most investors use major exchange platforms or cryptocurrency price tracking websites that offer live SHIB price updates, historical charts, and indicators such as volume and market cap.

What role does social media play in SHIB price movements?

Social media platforms significantly impact SHIB by amplifying news, rumors, and trends, often triggering rapid price movements due to coordinated actions or viral content.

Is SHIB’s value tied to any specific project or ecosystem?

While SHIB started as a meme coin, its value now partially relates to developments in its ecosystem, including the launch of ShibaSwap and ongoing efforts like Shibarium aimed to enhance utility.

What are some common risks associated with investing in SHIB?

SHIB remains highly volatile, with its price vulnerable to changing investor sentiment, potential regulatory actions, and the project’s ability to deliver on promised technical upgrades.

Can SHIB reach new highs in the future?

While future price performance depends on many factors, including market conditions and ecosystem progress, predicting significant price appreciation is speculative and involves considerable risk.