Crypto investments live and die by the power of prediction. Among the digital assets watched most closely by traders and institutional eyes alike is XRP—the native token of the XRP Ledger, powered by Ripple Labs. Since its creation, XRP has been dogged by both legal turbulence and fervent optimism, often resulting in dramatic price swings. Accurate XRP price prediction remains a hotly debated topic, especially as courts, global remittance trends, and macroeconomic factors shape its future. This article delves into expert analyses, recent developments, and the foundational factors fueling the discussion around XRP price outlooks.

The Foundations: What Drives XRP’s Price Movements?

Unlike Bitcoin or Ethereum, XRP’s value proposition centers on utility in global payments and cross-border transactions. Ripple’s mission to replace inefficient banking systems with its superior technology anchors XRP’s narrative, but several layers drive daily and long-term price action:

Supply Dynamics and Token Distribution

The maximum supply of XRP is 100 billion tokens—most of which are held in escrow by Ripple Labs. Regular releases impact liquidity and pricing pressures on secondary markets. Sudden releases or pausing of token sales can rapidly alter sentiment, as seen in previous market cycles.

Global Adoption and Strategic Partnerships

Banks and financial institutions that leverage Ripple’s solutions provide organic demand. Past collaborations with firms like Santander and American Express have bolstered XRP’s credibility, but widespread adoption remains a work in progress. Market observers track every RippleNet expansion or central bank pilot as signals of potential surges.

Regulatory Clarity and Legal Developments

Arguably nothing has influenced XRP’s price prospects more than ongoing legal disputes, most notably the U.S. Securities and Exchange Commission (SEC) lawsuit alleging XRP is a security. A single court ruling can send the asset’s price soaring or crashing—as evidenced by double-digit volatility after every major legal update.

“Market confidence in XRP is directly proportional to regulatory certainty. Each step towards legal resolution has immediate and lasting impacts on its price trajectory,” notes crypto analyst Jeremy Dawson.

Historical Performance: Peaks, Valleys, and Narratives

XRP has a distinct price history compared to other top tokens. During the 2017 bull run, it surged to all-time highs above $3.00, driven by speculative retail flows and hopes of mass adoption. Subsequent retracements, regulatory overhang, and bear markets saw it drift below $0.20 at points in 2020. More recently, renewed interest following favorable legal outcomes and surging crypto market sentiment pushed XRP to revisit key resistance levels, though not yet matching past peaks.

Comparing XRP to Other Top Cryptos

- Volatility: XRP exhibits above-average volatility, exceeding even some smaller altcoins, due in part to ongoing legal and market reactivity.

- Correlation: While XRP often moves in tandem with Bitcoin and broader market phases, it also shows unique price movements aligned with Ripple-specific news.

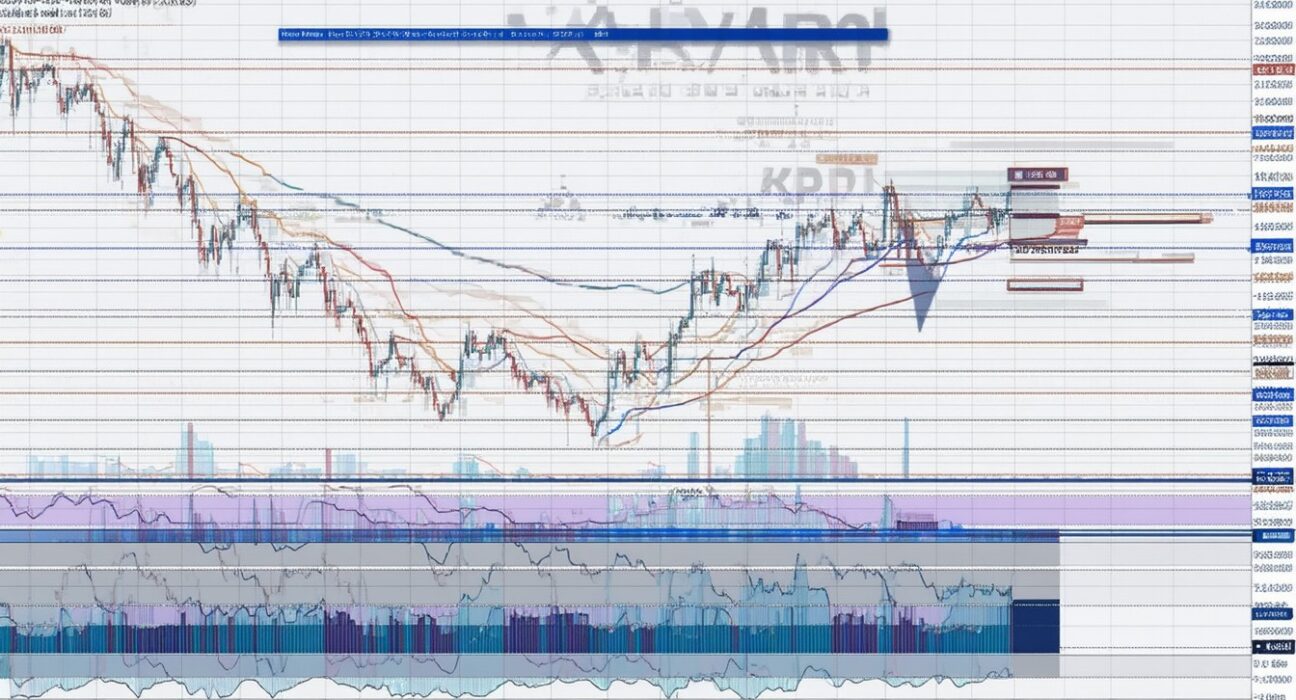

Technical Analysis: Charting Possible Price Scenarios

Technical indicators provide crucial guidance for traders and long-term holders alike. Here’s how seasoned analysts currently interpret XRP’s price charts:

Key Support and Resistance Levels

- Support: Historically, the $0.40–$0.50 range acts as a psychological floor; price retracements often find buyers here.

- Resistance: The $1.00–$1.20 region remains formidable. Analysts view a firm break above this as a bullish signal for revisiting multi-year highs.

Momentum and Moving Averages

Recent price action has seen XRP oscillate near its 200-day moving average—a classic metric for identifying long-term trend shifts. Sustained closes above this average historically indicate bullish momentum, while repeated failures can signal potential downside.

On-Chain Metrics

Data from blockchain explorers often reveals spikes in transaction activity and wallet creation before major price movements. Periods of rising on-chain activity—especially following regulatory news—frequently precede upward price moves.

Expert Predictions for XRP’s Future Price

Industry forecasters remain divided, though several themes unite their outlooks:

-

Bullish Case: Should Ripple win significant legal clarity, industry voices anticipate swift capital flows and new product integrations, catapulting XRP past its historic resistance bands. Some experts posit price targets above $2.00 in an optimistic scenario within the next market cycle.

-

Bearish Signals: Adverse rulings or further regulatory delays could dampen sentiment, with prices potentially retesting support zones or underperforming versus peers.

-

Long-term Neutral: Others advocate a measured approach, arguing that predictable, stable growth will depend on Ripple’s ability to secure multinational banking integrations and distance itself from speculation.

Scenario Analysis: From Regulation to Adoption

- Scenario 1: SEC case resolved in Ripple’s favor = renewed exchange listings, price breakout.

- Scenario 2: Continued legal gridlock = price stagnation, underperformance.

- Scenario 3: Large-scale partner announcements (e.g., central bank pilots) = moderate, steady price appreciation.

Real-World Use Cases and Market Sentiment

Beyond its legal drama, XRP enjoys real use cases. Its speed and near-instant transaction settlement have enabled successful remittance pilots in regions like Southeast Asia and the Middle East. In practice, however, large-scale institutional adoption has moved slower than many envisioned.

Still, growing interest from payment service providers and fintech startups—coupled with social media sentiment shifts following legal victories—underscore the role of perception in driving price.

Risks and Caveats: What Can Go Wrong?

Investors must weigh several key risks when evaluating XRP’s prospects:

- Legal setbacks: Future adverse rulings could jeopardize U.S. market presence.

- Market competition: Emerging technologies (e.g., central bank digital currencies or other blockchain solutions) may threaten Ripple’s unique value proposition.

- Overreliance on news: Frenzied trading following media events can contribute to unpredictable short-term swings, increasing the risk for retail investors.

Conclusion: Navigating the Road Ahead for XRP

Predicting the price of XRP is a multidimensional challenge—more art than science. While technical analysis and on-chain data can offer valuable signals, the largest determinants remain regulatory trajectory and real-world usage in global finance. For traders and investors, balancing technical signals with news-driven events and adoption milestones will be key. As the environment evolves, staying informed and maintaining a disciplined approach is the prudent path forward.

FAQs

What are the main factors influencing XRP price predictions?

Major drivers include regulatory developments (especially the SEC case), Ripple’s institutional partnerships, overall crypto market trends, and technical support and resistance levels.

How do legal outcomes affect XRP’s price?

Favorable legal decisions tend to boost confidence and price, often resulting in rapid upward moves. Negative or ambiguous rulings can depress price and lead to increased volatility.

Is XRP a good investment for the long term?

XRP carries both significant upside potential and notable risks due to its legal situation and competitive landscape. It can be suitable for risk-tolerant investors with a keen eye on news updates.

What technical indicators do analysts watch on XRP?

Commonly monitored metrics include moving averages (especially the 200-day), historical support/resistance zones, and on-chain activity such as wallet creation and transaction volume.

How does XRP compare with Bitcoin and Ethereum in terms of performance?

XRP generally exhibits higher volatility than Bitcoin or Ethereum, with price closely tied to Ripple-specific news and regulatory themes rather than only broad market shifts.